Poland is currently the premier hub for tech talent in Central Europe, home to over 650,000 IT professionals. However, for international companies, the most confusing aspect of hiring developers Poland legal frameworks is the choice between two distinct contract models: the Employment Contract (Umowa o Pracę or UoP) and the Business-to-Business (B2B) contract.

Choosing the right model is not just about compliance; it is a strategic decision that impacts your budget, the developer’s net income, and the speed of hiring. In this guide, I break down UoP vs B2B Poland to help you make the right choice for your tech team.

The Two Main Models Explained

In Poland, the employment landscape for software engineers is unique because a significant portion of senior talent prefers to operate as independent contractors rather than traditional employees.

1. Employment Contract (UoP – Umowa o Pracę) This is the standard employment model regulated strictly by the Polish Labor Code. It offers high security for the employee but comes with higher costs and administrative burdens for the employer.

- Stability: Strong protection against dismissal.

- Paid Leave: Guaranteed 20 or 26 days of holiday per year.

- Sick Leave: Fully covered by social security (ZUS) after 33 days.

- Notice Period: Statutory periods of 2 weeks to 3 months based on tenure.

2. B2B Contract (Business-to-Business) A B2B contract Poland is a civil law agreement between two companies: your company (or your EOR/agency) and the developer’s sole proprietorship. This is the preferred model for mid-to-senior developers because it maximizes their take-home pay through favorable tax rulings.

- Flexibility: Terms like notice periods and holidays are negotiable, not statutory.

- Higher Net Pay: Developers often pay a flat tax (12% or 19%) rather than progressive rates.

- Speed: Contracts can be signed and terminated faster than UoP.

- Cost Efficiency: Employers save ~20% on total employment costs compared to UoP.

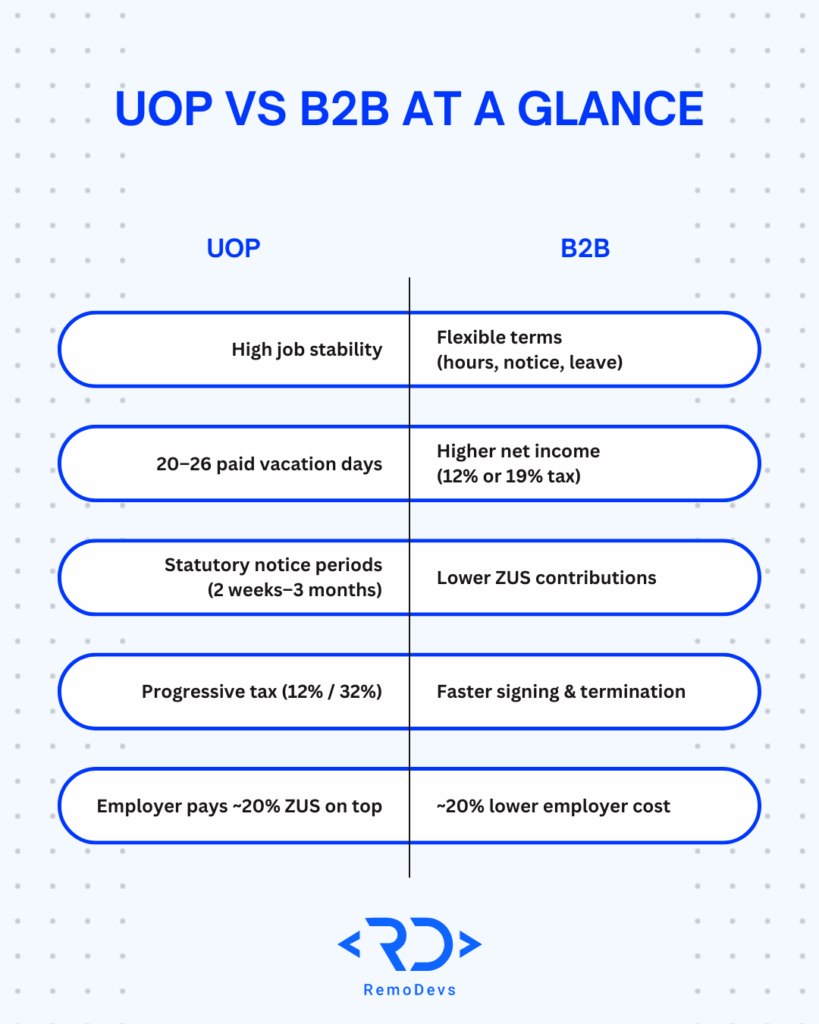

Detailed Comparison: UoP vs B2B Poland

To visualize the differences, here is a direct comparison of the liabilities and benefits associated with each model.

- Taxes (Developer): UoP uses a progressive scale (12% up to ~120k PLN, then 32%). B2B allows for a flat 19% or a specialized IP Box/Lump Sum rate (often 12% for IT).

- Social Security (ZUS): On UoP, the employer pays roughly 20% on top of the gross salary. On B2B, the developer pays a fixed, lower monthly amount.

- Termination: UoP requires specific justifications and adheres to strict notice periods (up to 3 months). B2B termination depends entirely on the contract clauses.

- Overtime: UoP requires overtime pay (150-200%). B2B usually includes “availability” in the rate or bills hourly without statutory multipliers.

Why Senior Developers Prefer B2B

When hiring developers Poland legal questions arise, clients often ask why candidates refuse standard employment. The answer lies in the tax system. A senior developer earning a high salary would lose nearly a third of their income to taxes under UoP.

- Tax Optimization: B2B allows deducting business costs (leasing, equipment) from taxable income.

- Ryczałt (Lump Sum): Many developers qualify for a 12% tax rate on revenue, significantly boosting net income.

- Freedom: They act as partners, often working for multiple clients (though usually dedicated to one primary project).

By agreeing to a B2B contract Poland, you make your job offer significantly more attractive to top-tier talent.

| Scenario | UoP Recommended | B2B Recommended |

| Long-term, high-control employment | ✔ | |

| Need strict working hours | ✔ | |

| Hiring juniors or early-career developers | ✔ | |

| Need fast onboarding | ✔ | |

| Hiring senior developers | ✔ | |

| Budget-sensitive project | ✔ | |

| Temporary or contract-based project | ✔ |

Hiring Without a Local Entity

If you are a US or UK-based company without a registered branch in Poland, you cannot legally hire someone on a UoP directly. You would need to use an Employer of Record (EOR). However, B2B contracts offer a smoother alternative.

- Direct Invoicing: The developer sends you an invoice for “Software Development Services” monthly.

- No Payroll Headache: You do not handle Polish withholdings, ZUS, or PIT (income tax).

- Compliance: You simply pay a vendor invoice.

For a deeper dive into this specific workflow, read our guide on how to hire software developers in Poland without a local entity.

Risks and Compliance

While B2B is popular, it must be structured correctly to avoid “misclassification” risks. Polish authorities check if a B2B contractor is actually a disguised employee.

- Independence: The developer should define how and when they work (within reason).

- Equipment: Ideally, contractors use their own hardware, though providing a secure laptop is common practice.

- No Subordination: Avoid treating them exactly like internal staff in official documentation (e.g., “approving” holiday requests vs. “accepting non-availability”).

Conclusion

For most international tech companies, the B2B contract Poland model is the superior choice. It aligns with the preferences of senior talent, reduces employer liability, and simplifies cross-border payments. However, if you require absolute control and long-term loyalty characteristic of traditional employment, UoP (via an EOR) remains a valid option.

Ready to build your team without the legal headache? Navigating local labor laws shouldn’t slow down your growth. At RemoDevs, we specialize in sourcing top-tier talent and helping you navigate the B2B vs. UoP landscape effortlessly. Schedule a free consultation with us today to start hiring your dream team in Poland in as little as 7 days.

Visit us

Find a moment in your calendar and come to our office for a delicious coffee

Make an apointment