Poland has emerged as a major technology hub, attracting global giants like Google and Meta. One of the key strategies for tapping into this thriving ecosystem is to hire self-employed IT professionals.

This approach not only provides flexibility and access to specialized skills but also offers significant tax benefits.

The Rise of Self-Employed IT Professionals in Poland

In Poland, self-employed IT professionals, often working as sole proprietors or under B2B contracts, are a cornerstone of the tech industry. They offer a wide range of services, including software development, IT consulting, and system analysis.

The trend of hiring these professionals is on the rise, driven by their specialized expertise and the cost-effectiveness of this model for businesses.

Major Tax Benefits for Companies

The most significant financial advantage for companies hiring self-employed IT talent in Poland is the avoidance of employer social security contributions.

When hiring a traditional employee, a company is obligated to pay approximately 20.74% of the employee’s gross salary to the Social Security Institution (ZUS). For a self-employed contractor, these contributions are not required, leading to substantial savings.

| Obligation | Hiring an Employee | Hiring a B2B Contractor |

| Social Security Contributions | Required (~20.74%) | Not Required |

| Statutory Paid Leave (Urlop) | Required (20–26 days/year) | Not Required |

| Pension Scheme Contributions (PPK) | Required | Not Required |

| Formal Notice Period | Required (Varies by law) | Defined by Contract |

| Sickness Pay | Required | Not Required |

These factors make hiring self-employed professionals a financially attractive option.

For a deeper dive into scaling your team with Polish talent, explore how to scale your engineering team fast with Polish talent.

Cost Comparison: Employee vs. Self-Employed Contractor

Let’s illustrate the cost savings with a clear example. Consider a software engineer with a gross monthly salary of PLN 10,000.

- Employee: The total cost to the employer would be approximately PLN 12,074, including the 20.74% social security contributions.

- Self-Employed Contractor: The cost is limited to the agreed-upon fee, which could be PLN 10,000 or a slightly higher amount to account for the contractor’s own tax obligations.

This straightforward comparison highlights the immediate cost benefits. To understand more about the specifics of hiring in Poland, our guide on how to hire software developers in Poland provides valuable insights.

How Polish IT Professionals Optimize Their Taxes

Self-employed IT professionals in Poland can take advantage of the “Ryczałt” (lump-sum) tax system, which allows them to pay taxes on their revenue at favorable rates. This system enables them to offer competitive pricing, which in turn benefits the companies that hire them.

- 8.5% Rate: Applies to services such as IT consulting, testing, and system analysis.

- 12% Rate: Applies to services like software development.

These lower tax rates allow contractors to maintain a healthy income while offering their services at a cost-effective price point.

If you’re looking to hire Python developers in Poland, for example, you’ll find that many of them leverage this tax system.

Ensuring Compliance and Avoiding Risks

While the benefits are clear, it is crucial to ensure compliance with Polish labor laws to avoid the risks of misclassification. A B2B contract can be reclassified as an employment relationship if it doesn’t meet the legal criteria for genuine self-employment.

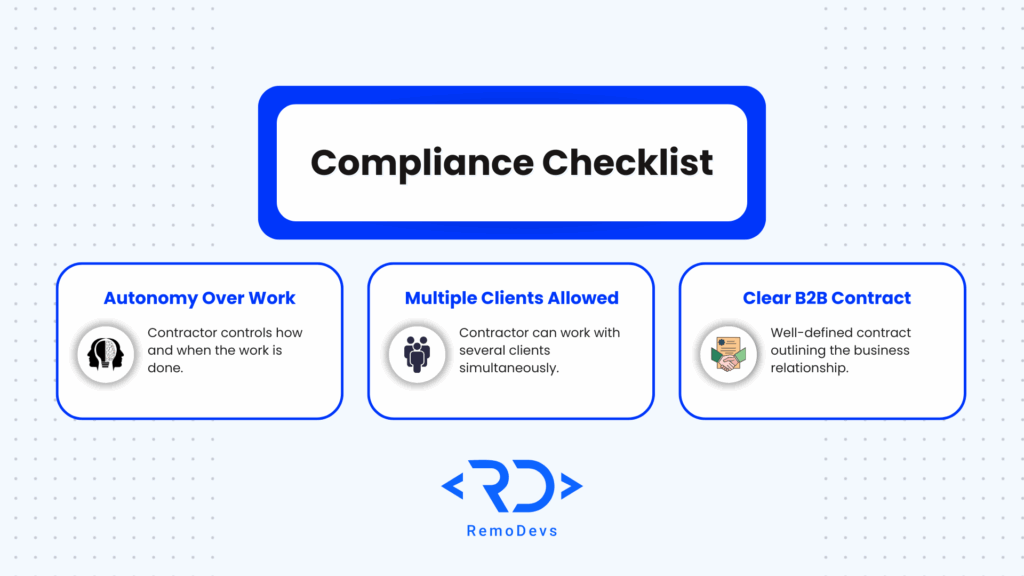

To avoid this “entrepreneur test,” the following must be in place:

- Autonomy: The contractor must have control over their work methods and schedule.

- Multiple Clients: The ability to work for multiple clients is a key indicator of self-employment.

- Clear Contracts: A well-structured B2B contract is essential to define the relationship and prevent reclassification, which could lead to penalties and back payments of taxes and social security contributions.

For companies new to the Polish market, navigating these regulations can be complex. Partnering with an experienced recruitment agency like RemoDevs ensures that you find the right talent while remaining compliant.

Our article on the key reasons to outsource IT roles to Poland provides further context on this topic.

Conclusion: Your Gateway to Polish IT Talent

Hiring self-employed IT professionals in Poland offers a powerful combination of cost savings, flexibility, and access to a deep pool of skilled talent.

By avoiding employer social security contributions and leveraging the competitive pricing made possible by the Ryczałt tax system, companies can significantly reduce their operational costs. However, maintaining compliance is key to realizing these benefits.

As the leading IT recruitment agency in Poland, RemoDevs is your trusted partner in navigating the Polish tech landscape. We connect you with top-tier, self-employed IT professionals, ensuring you can build a world-class team while maximizing your tax advantages.

Ready to explore the best cities in Poland to hire software developers? Contact RemoDevs today to start building your dream team.

Visit us

Find a moment in your calendar and come to our office for a delicious coffee

Make an apointment