The Polish IT market in 2026 continues to solidify its reputation as a European technology powerhouse. With a mature ecosystem that has successfully transitioned from a cost-effective outsourcing destination to a hub of high-value innovation, Poland attracts global investors seeking quality and stability.

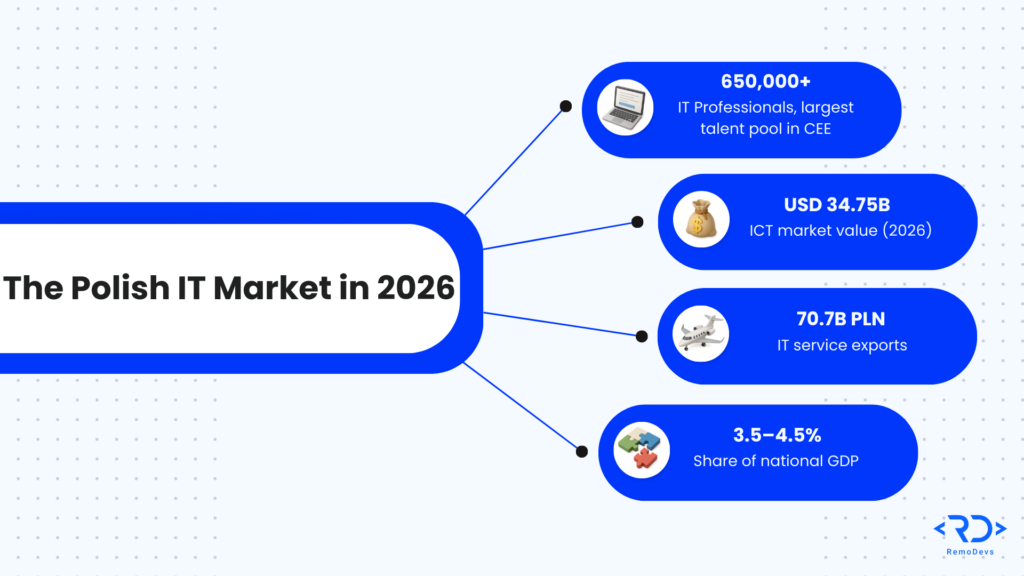

- Market Scale: The sector now boasts a talent pool of over 650,000 IT professionals, positioning it as the largest in the CEE region.

- Economic Impact: The ICT market value is projected to reach USD 34.75 billion in 2026.

- Global Reach: Polish IT service exports are breaking records, confirming the country’s strategic role in the global digital supply chain.

For businesses and investors, the Polish IT market report 2026 offers critical insights into a sector that has proven resilient against economic fluctuations. As companies worldwide compete for top-tier engineering talent, understanding the dynamics of developer salaries in Poland and the evolving IT trends in Poland is essential for strategic decision-making.

Overview of the Polish IT Market in 2026

The trajectory of Poland’s technology sector remains steeply upward. Moving beyond simple code delivery, the market is now characterized by complex R&D projects and deep integration with Western economies.

- Growth Projections: Analysts forecast the ICT market to expand from USD 31.59 billion in 2025 to USD 34.75 billion in 2026, driven by a Compound Annual Growth Rate (CAGR) of 10.02% expected through 2031.

- Export Dominance: IT service exports surged to 70.7 billion PLN in 2023, representing approximately 13% of the nation’s total service exports – a clear indicator of the sector’s international competitiveness.

- Infrastructure: Poland is emerging as a data center leader in Central and Eastern Europe, with IT load capacity set to jump from 660 MW in 2025 to 930 MW by 2030.

This expansion contributes significantly to the broader economy, with the IT sector’s share of GDP estimated between 3.5% and 4.5%. This resilience is bolstered by strong fundamentals and a continuous influx of foreign direct investment.

Key IT Trends in Poland for 2026

The year 2026 is defined by specialized growth. As general demand stabilizes, niche technologies are experiencing an explosion in activity, reshaping recruitment and project pipelines.

- AI & Machine Learning: The “AI gold rush” has led to a 22% year-over-year increase in job postings for AI/ML specialists, driven by enterprise automation needs.

- Cybersecurity Focus: With heightened digital threats and strict EU regulations, security-related roles have seen a 39% surge in demand.

- Green Tech & Cloud: Public cloud services are expanding at a 17.78% CAGR, while data centers increasingly adopt renewable energy to meet sustainability goals.

Emerging hubs are diversifying the map. While Warsaw remains the capital of finance and tech, cities like Kraków and Wrocław are cementing their status as innovation centers for hiring tech talents and R&D.

| Technology Area | Demand Growth | Key Driver |

| AI & Machine Learning | +22% YoY | Enterprise automation |

| Cybersecurity | +39% | EU regulations & threat growth |

| Cloud Computing | 17.78% CAGR | Digital transformation |

| Green Tech | Rapid adoption | Sustainability mandates |

| R&D & Innovation | Increasing | Shift from outsourcing to IP |

Developer Salaries in Poland 2026

Understanding compensation is crucial for any company looking to build a team in Poland. In 2026, developer salaries in Poland remain highly competitive compared to Western Europe and the US, despite steady domestic growth.

- Average Benchmarks: Annual salaries for experienced developers hover around 225,000–231,000 PLN (approx. USD 55,000–57,000), though top talent in niche fields commands more.

- Seniority Breakdown:

- Junior: ~EUR 2,100 net (B2B monthly)

- Mid-level: ~EUR 4,395 net (B2B monthly)

- Senior: ~EUR 5,760 net (B2B monthly)

- Contract Types: B2B contracts remain popular, often offering 13–26% higher net income for developers compared to standard employment contracts.

Regional variations exist, with Warsaw offering the highest packages – seniors there can earn up to USD 70,000. specialized roles like AI/ML engineers see premiums, with senior averages reaching USD 80,400. Even with these increases, costs are roughly 2.5x lower than equivalent US rates.

For a deeper dive into compensation strategies, read our analysis on hire software developers in Poland.

Talent Landscape and Hiring Challenges in Poland

Poland’s primary advantage is the quality and depth of its workforce. With over 600,000 IT specialists, the country accounts for a significant 25% of the CEE region’s tech talent, supported by over 70,000 annual graduates in ICT fields.

- Hiring Dynamics: 82% of companies plan to recruit in 2026, but the focus has shifted from volume to quality and specialization.

- Recruitment Speed: For vetted candidates, the average time-to-hire can be as low as 10 days, providing a distinct agility advantage for global teams.

- Skills Gap: Despite the large pool, there is fierce competition for experts in IT recruitment trends such as DevOps, AI, and cybersecurity.

Global companies continue to flock to Poland not just for cost savings, but for English proficiency and cultural alignment. However, success requires navigating hidden costs of recruitment and understanding local expectations regarding remote work and benefits.

Future Outlook for the Polish IT Sector

Looking ahead, the sector is poised for sustained expansion. The long-term forecast sees the ICT market potentially reaching USD 56.01 billion by 2031.

- Strategic Investments: Continued EU incentives for sustainable tech and digital transformation will fuel growth in green data centers and cloud infrastructure.

- Risks to Watch: Regulatory shifts, such as cloud provider transitions, and economic fluctuations could impact short-term stability.

- Global Position: Poland is evolving into a key data interconnection hub for Europe, leveraging its central location and robust fiber infrastructure.

As the market matures, companies must adapt by investing in continuous upskilling and leveraging expert partners to navigate the competitive recruitment strategies required to secure top talent.

Conclusion

The Polish IT market report 2026 paints a picture of a sector that is both mature and dynamic. With competitive developer salaries in Poland and a workforce that is rapidly adapting to new IT trends in Poland like AI and cybersecurity, the country remains a premier destination for technology investment.

Ready to build your dream team? For businesses seeking top Polish IT talent without the administrative burden, Contact us to accelerate your team’s growth in 2026.

Visit us

Find a moment in your calendar and come to our office for a delicious coffee

Make an apointment